Every month I try to find ways to save money and limit unnecessary expenses. With food, gas, and rent at an all time high- it is more important than ever to budget and save money whenever I can. I hope you enjoy this post on the 9 things that I do every month to save money!

Budget

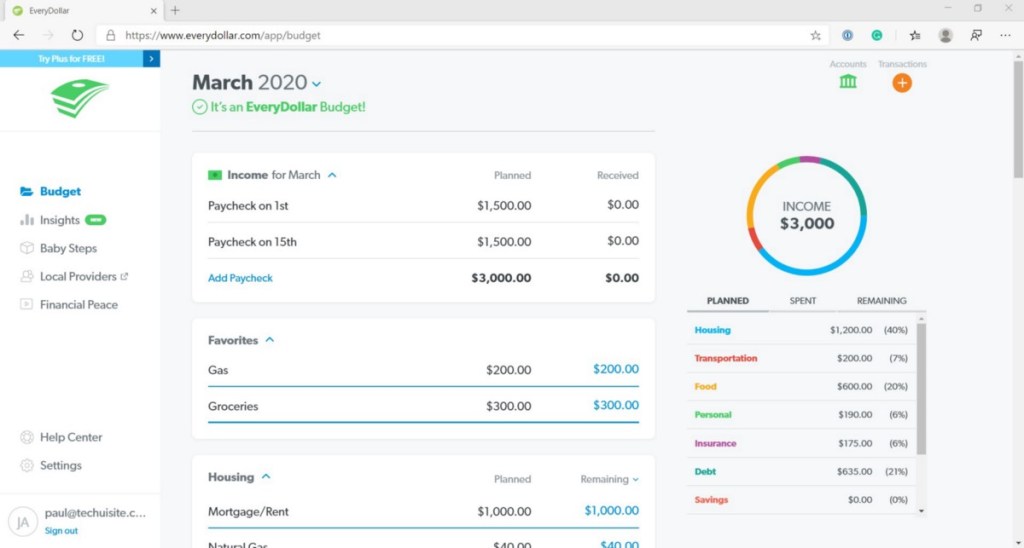

It’s probably no surprise that first on the list is to make a budget. Creating a written plan for your money and knowing where every dollar is going will set you up for success. I use EveryDollar to track all my expenses. It will save you hundreds, if not thousands of dollars in the long run.

Need help creating a budget? Check out this video to get started.

Prepaid Phone Plan

I recently switched my phone plan to a prepaid plan. Most every company has these options and they are much cheaper than the traditional plans! I pay $15 a month for unlimited talk/text and 2 GB of data.

According to an article by MoneySavingsPros, the average cell phone bill in the U.S is $114. That adds up to $1,368 a year just on a cellphone plan. With the new norm of working/staying at home, I have found that I seldom use internet data on my phone. Even when I’m outside of my home, I rarely use data. The data limit helps me save money and be more intentional with my screen time away from home.

I saved $35 a month/ $420 a year by switching to a prepaid phone plan!

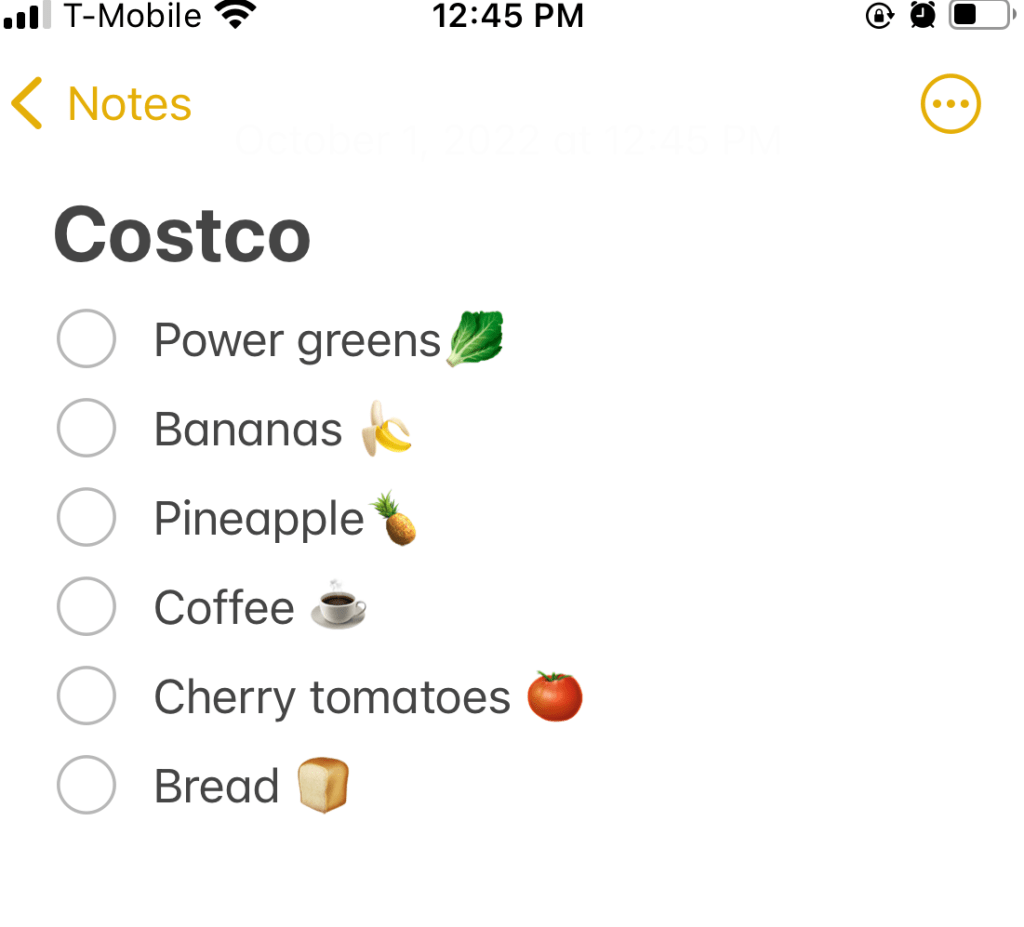

Make a Shopping List

Whether you’re going to Sephora, Dollar Tree, Target, Costco, Trader Joe’s, or Cardenas make sure to always make a list of what you NEED before going to the store. There is always going to be a sale or something that catches your eye so it’s important not to get distracted and easily fill up your shopping cart with wants instead of needs.

Go to the Library

I stopped buying books a couple of years ago and started renting books from my local library instead. By doing this, I reduce the clutter in my home while engaging in my community and also putting my tax dollars to use. Libraries have so many awesome services you can use for little to no cost. You can use computers, print, rent books/ebooks/laptops, take classes, get tutoring, and even rent movies! If you haven’t already, go check out your local library today 🙂

Go to a Cheap Car Wash

I go to a $7 drive through car wash in Highland Park that has free vacuums and they have someone do a quick dry of your windows for you. If you go on weekday mornings you can get the early bird special of $2 off any wash! This option gets the job done for me every month in a quick, efficient, and money friendly way.

Groupon

I use Groupon for manicures, haircuts, and waxing services that can be up to 50% off the regular price!

Buy in bulk

For non-perishable items like toilet paper, nuts, rice and beans, I like to buy in bulk to save a few extra dollars and limit my outings to the store.

Take Public Transit

With gas prices through the roof, I like to use public transit when possible. Metrolink’s one-way ticket is only $2 in L.A and takes the hassle out of finding/paying for parking in the city.

Plan your Outings Around Happy Hour

Who doesn’t LOVE a good happy hour?! By planning my outings around happy hours I save at least a hundred dollars a month and enjoy the intentionality behind planning a fun date/outing with my husband and friends. Below are some of my favorite, and in my opinion, the BEST happy hours in town with food & drink specials!

Edwin Mills: 22 Mills Pl, Pasadena, CA 91105

ETA: 5630 N Figueroa St, Los Angeles, CA 90042

Highland Park Theatre: 5604 N Figueroa St, Los Angeles, CA 90042

The Greyhound: 5570 N Figueroa St, Los Angeles, CA 90042

What’s something you do every month to save money? Share your tips in the comments below!

Leave a comment